likelihood of capital gains tax increase in 2021

It would also nearly double taxes on capital gains to 396 for people earning more than 1 million. Various media reports indicate the president will propose taxing capital gains at the top ordinary tax rate which would be 434 when including the current 38 on net.

What You Need To Know About Capital Gains Tax

Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales.

. If a change is announced in the Budget when will the capital gains tax rates go up. Likelihood of capital gains tax increase in 2021 Tuesday June 14 2022 Edit. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund.

However it was struck down in March 2022. While it is unknown what the final legislation may contain the elimination of a rate. 2 days agoAs the Chancellor is weighing up difficult decisions to address a 50bn black hole in the public finances Jeremy Hunt is looking at raising taxes on the sale of assets such as.

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. Assume the Federal capital gains tax rate in 2026 becomes 28. Capital gains taxes simply are taxes levied on profits from selling an investment.

So if you buy 10000 in stock and sell those shares five years later for 20000 you will likely. A retroactive change may be hard to get through congress because capital gains rates have been consistently low for a while but it is still possible an increase could take effect for all or part of. This tax change is targeted to fund a 18 trillion American Families Plan.

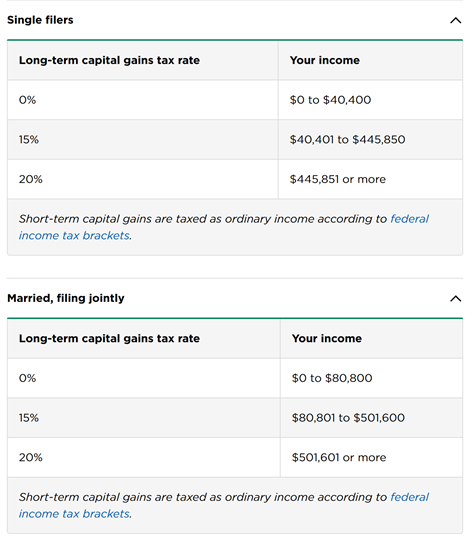

4 rows But the tax rate that will apply to your long-term capital gains does depend on what your. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a.

Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. That would be the highest tax rate on investment gains which are mostly paid. Based on the way the government has introduced tax changes in the past there are two likely.

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

Potential Increase In Capital Gains Tax Drives Business Owners To Seek Timely Exits Fe International

California State Government Will Lose Big From Capital Gains Tax Increase Econlib

How Will Capital Gains Tax Increases In 2022 Impact M A This Year Clearridge

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

Crypto Capital Gains And Tax Rates 2022

Why A Capital Gains Tax Increase Would Be A Massive Jobs And Wealth Killer Foundation For Economic Education

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Capital Gains Tax Rates And Economic Growth Or Not

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Biden S Election Doesn T Mean You Have To Sell In 2020 Rosebiz Inc

What Are The Capital Gains Tax Rates For 2022 Vs 2021 Avitas Capital

Capital Gains Tax In The United States Wikipedia

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition